Welcome To

Grand Strand Opportunity Zones

What Is An Opportunity Zone?

Opportunity Zones are a new community development program established by Congress as a part of the Tax Cuts and Jobs Act of 2017. They are designed to encourage long-term private investments in low-income communities. This program provides a federal tax incentive for taxpayers who reinvest unrealized capital gains into "Opportunity Funds," which are specialized vehicles dedicated to investing in low-income areas called "Opportunity Zones."

The zones themselves are comprised of low-income community census tracts and designated by governors in every state. South Carolina designated 25 percent of qualifying census tracts as an Opportunity Zone. Qualifying Zones are based on the 2011-2015 American Community Survey.

Grand Strand Opportunity Zones Mission

- Promoting economic vitality in parts of the state that have not shared in the general prosperity over the past few years

- Funding the development of workforce and affordable housing in areas with escalating prices and inventory shortages

- Funding new infrastructure to support population and economic growth

- Investing in startup businesses who have potential for rapid increases in scale

- Upgrading the capability of existing underutilized assets through capital improvement investments

How Does An Opportunity Zone Work

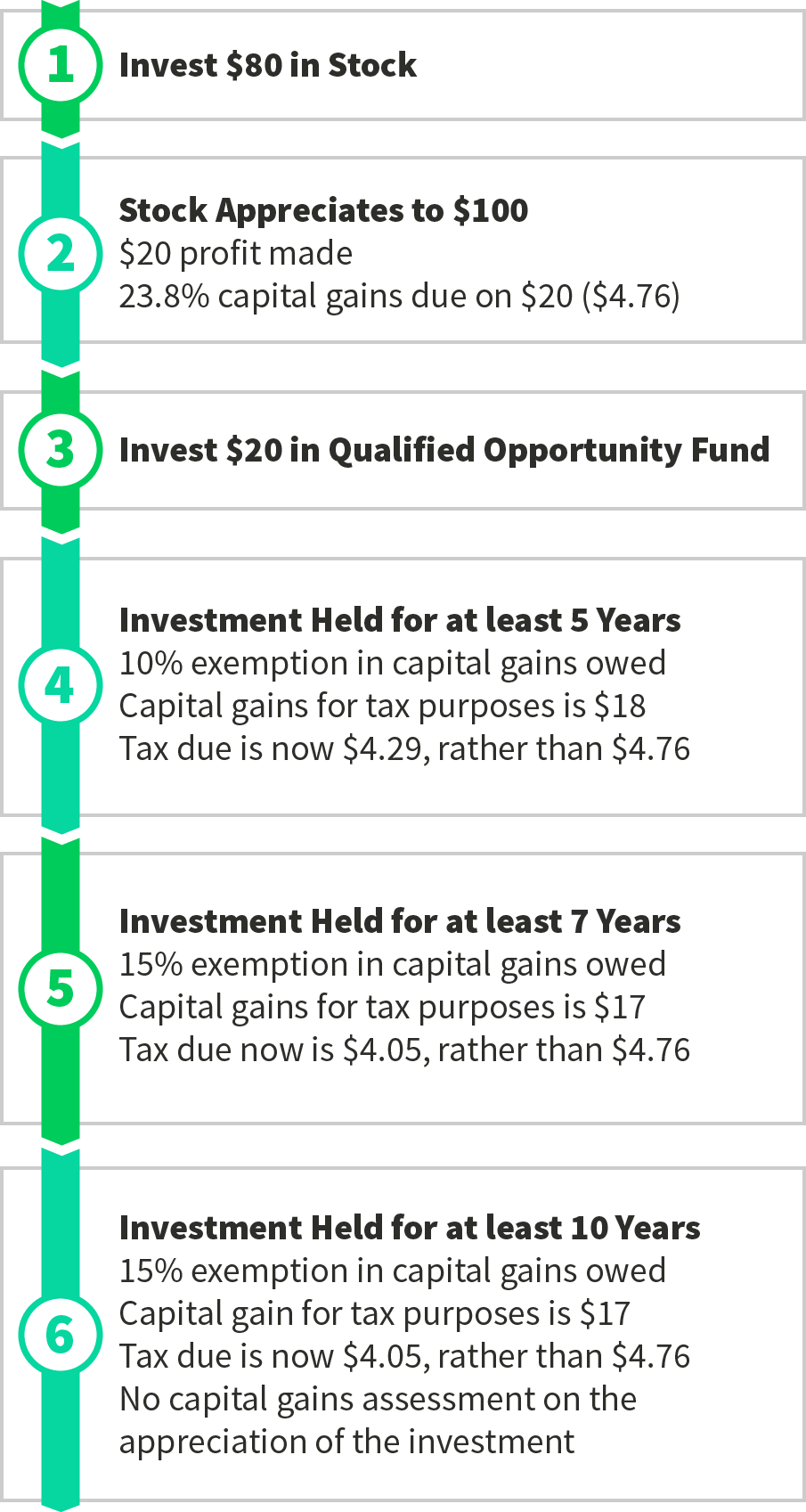

The Opportunity Zones program offers investors the following incentives for putting their capital to work in low-income communities:

- Investors can roll existing capital gains into Opportunity Funds with no up-front tax-bill

- A 5 year holding results in a 10% exemption in capital gains owed

- A 7 year holding results in a 15% exemption in capital gains owed

- Investors can defer their original tax bill until December 31, 2026 at the latest, or until they sell their Opportunity Fund Investments, if earlier

- If opportunity fund investments are held for at least 10 years, there will be no capital gain whatsoever on the appreciation of the investment

*From this example, an investor utilizing the opportunity fund would pay 15% less capital gains tax after 10 years than an investor not utilizing the fund. Additionally, no capital gains tax would be due on the appreciation of the investment after 10 years.

Frequently Asked Questions

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury. Opportunity zones align with US Census Tract boundaries.

Who created Opportunity Zones?

Opportunity Zones were added to the tax code by the Tax Cuts and Jobs Act on December 22, 2017.

When were the Opportunity Zones created?

The first set of Opportunity Zones, covering parts of 18 states, were designated on April 9, 2018.

What is the purpose of Opportunity Zones?

Opportunity Zones are an economic development tool. They are designed to spur economic development and job creation in distressed communities.

How do Opportunity Zones spur economic development?

Opportunity Zones are designed to generate economic development by providing tax benefits for investors. First, investors can defer tax on any prior gains until the earlier of the date on which an investment is sold or exchanged, or December 31, 2026, so long as the gain is reinvested in a Qualified Opportunity Fund. Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor would incur no tax whatsoever on a sale of the Opportunity Zone investment.

What is an Opportunity Fund?

An Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in an Opportunity Zone. This fund utilizes the investor's gains from a prior investment for funding the Opportunity Fund.

Do I need to live in an Opportunity Zone to take advantage of the tax benefits?

No. You can get the tax benefits, even if you don't live, work, or own a business in an Opportunity Zone. All you need to do is invest in a Qualified Opportunity Fund.

Who can establish an Opportunity Fund?

The enabling statute allows for a vast range of investors to invest in a variety of needs in designated Opportunity Zones. Any entity, including regional economic development groups, can establish a fund, as long as they adhere to the program guidelines. Additionally, an individual taxpayer can self-certify as an Opportunity Fund by completing a form (to be released in Summer 2018) to be attached to the applicable income tax return. Additional program guidance will be forthcoming from the US Treasury in the next year.

What can an Opportunity Fund invest in?

Investments are allowed to be made in operating businesses, equipment, and real property in a variety of ways. Funds can be utilized to purchase equity investments and stock of a company, provided if nearly all of the company's tangible property is located within a designated Opportunity Zone. Funds can invest in an interest in a partnership which adheres to this criteria as well. Funds can invest in real estate or infrastructure, provided that the initial use of the property begins with the fund investment, or if the fund provides for substantial improvements to the property.

How much investment is the program expected to catalyze?

It is difficult to judge the potential impact of the program at this point. As of the beginning of 2018, an estimated $3.8 trillion of unrealized capital gains was held nationally by individuals through the sale of stocks and mutual funds. An additional $2.3 trillion in unrealized capital gains was held nationally by corporations. The effect of the program will be determined by investor demand and the supply of eligible opportunities.

Can I invest my capital gains directly in an Opportunity Zone business and qualify for the tax incentives?

Investments must be made through a qualified Opportunity Fund in order to qualify for the tax incentives.